- Promotions

What is a payment order?

A payment order is a financial instrument used by individuals, companies and government organizations to make money transfers. It is an official document from the payer to the bank, with an order to transfer a certain amount from his account to the account of the recipient. Its importance comes from its accuracy and security in banking transactions. But how is it filled?

Table of Contents

1. Basic components of payment orders

2. Applications and benefits

3. Steps in issuing a payment order

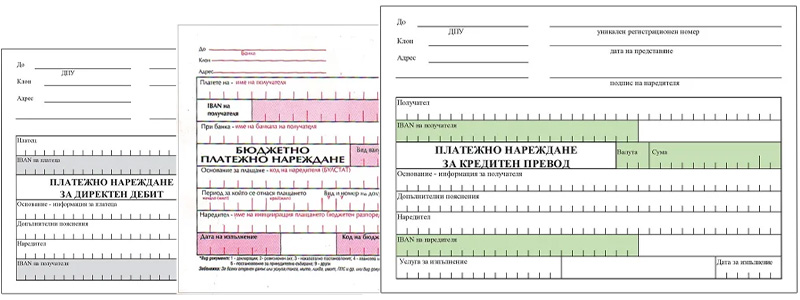

Basic components of payment orders

- Orderer. The orderer can be both an individual customer and a company. He must provide the necessary information to carry out the transaction, including the amount and the beneficiary.

- Bank top-up. They are filled out with the help of employees on the spot or electronically, ensuring the correctness of the data provided. The filling includes entering the details of the recipient and the sender, internal bank number and the transfer amount.

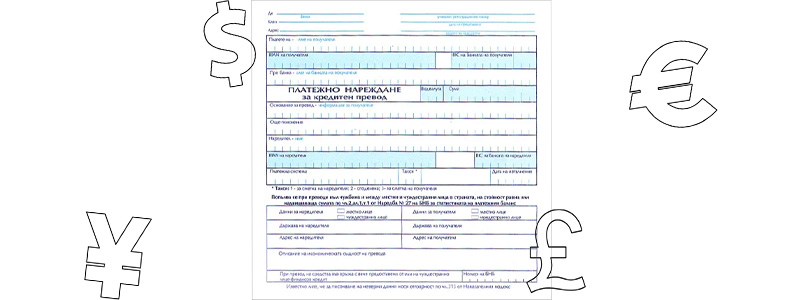

- Currency transaction. Payment orders can be used for transactions in both local and international currencies. In this context, all currency codes and symbols must be specified correctly, including for international transfers, to avoid errors.

Applications and benefits

- security and accuracy - guarantee the security and accuracy of money transfers, as each document is carefully checked by the bank before execution;

- universality – they are applied in various operations, including payments to the budget, corporate transactions and personal payments;

- proof document – the transfer order serves as proof of payment that can be used in legal and financial disputes.

Steps in issuing a payment order

- Choose an orderer.

- Fill in the required information with all mandatory transaction details.

- Make sure the information is accurate and double check before submitting to the bank.

- Sending or presenting the import bill to the bank for processing.

The payment order is a key tool in the management of financial flows in personal and corporate finance. It provides a safe and documented way to make payments, which is the basis for financial stability and trust between trading partners. Its importance is emphasized by the high requirements for accuracy and tracking of transactions, making it an indispensable part of modern banking operations.